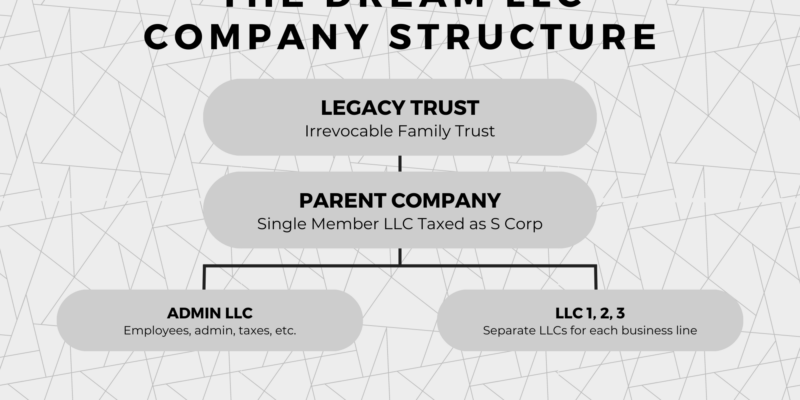

A parent company is, in summary, a company that owns another company. The parent company typically doesn’t do anything except own other companies (subsidiaries or child companies) and take in equity payments from those subsidiaries. In our Dream LLC Company Structure illustrated below, the parent company is the middle of the setup. What is a […]

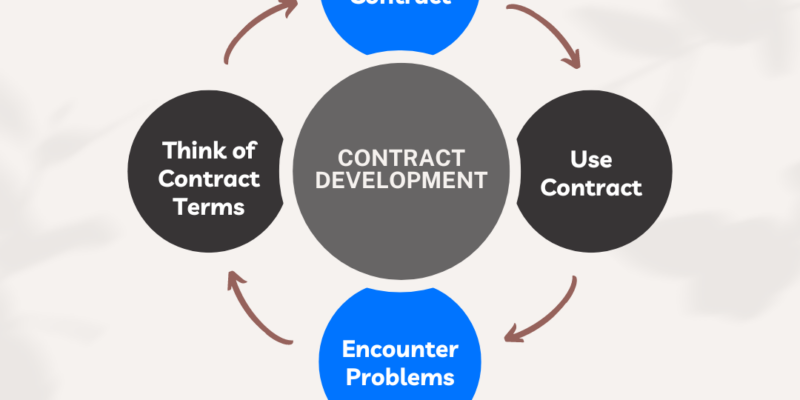

Service Contracts are Iterative

A standard service contract is meant to be iterative in nature. They are as long lasting as your business, and they should change when appropriate to do so. The goal, when writing a service contract, is to cover as any scenarios and pitfalls as possible up front. However, you can’t always catch everything. Often times, […]

Going Consultant After a Layoff

If you got laid off, you might be considering becoming a consultant after a layoff. A lot of people find this route a great way to bridge a gap between employment. You may even fall in love with it. Being a consultant comes with a lot of its own perks. You set your hours. You […]

What Does Law++ Do With Contracts?

What Does Law++ Do With Contracts? As part of an effort to help our community understand what we’re about, we’re answering this question. I spend more time on contracts than non-contract related activities in the firm. That’s probably because contracts encompass so many other areas of law. Mergers and Acquisitions, real estate, employment, and of […]

What Can I Do When A Client Does Not Pay?

When a client does not pay you, you have a few options. However, often times, your clients leave you limited options. Obviously, we prefer that everyone holds up their end of the bargain in every deal. Unfortunately, that’s not the world we live in. Proactively First and foremost, you need well written protective contracts. The […]

Amend Articles of Organization

If you want to amend your articles of organization, you’re in luck. The process is actually quite easy! Amendment of Articles of Organization Law If you want to read the law regarding articles of organization, you’ll want to start with NCGS §§ 57D-2-21 & 22. Why Would You Want to Amend Your Articles of Organization? […]

What Are Articles Of Organization?

Articles of Organization is the legal document you file to form an LLC. There are only a few requirements to make them legal. If you file the articles with the Secretary of State, and it contains all the proper information, you’ll get yourself an LLC. Of course, you’ll also have to pay the filing fee! […]

What is a Registered Agent?

What is a registered agent? This is the hardest part of any LLC or corporation formation. I should also mention it isn’t that hard. Firstly, I’m going to list the relevant laws. After that, I’ll explain what they mean. Then, I’ll conclude with some pointers. Unfortunately, the law is thick legalese. However, I wanted to […]

Angry Emails from Customers

Have you ever received angry emails from customers? If you have, I know how you feel. It’s that unpleasant, sinking feeling in your stomach. You can feel your heart pounding in your chest. And you want to defend yourself from this attack. You’re Not Alone First, let me just say you’re not alone. I’ve received […]

Business Trust

A Business Trust may be something that could benefit you. However, in most circumstances, you’d be better off without it. Read through our blog to see if it is something you can use versus something the internet says you need. The last thing we want to do is sell you something that you don’t need […]

Company Divesting: Diversification for Entrepreneurs

Company divesting is an important consideration for entrepreneurs. It is a fairly easy concept to understand, yet very difficult in practice. That said, there are ways you can go about this without ruining your company. What is Company Divesting? Company divesting is just a fancy way of saying you shouldn’t have all your eggs […]

Temporary Emergency Video Notarization

Edit as of 7/2/2020: The Emergency Video Notarization has been extended until March 1, 2021. This is part of the House Bill 308: AN ACT TO PROVIDE FURTHER REGULATORY RELIEF TO THE CITIZENS OF NORTH CAROLINA. Text of this bill: https://www.ncleg.gov/Sessions/2019/Bills/House/PDF/H308v7.pdf Part of Senate Bill 704 included a provision allowing the emergency authorization for all […]